Diageo CFO: Growth requires ‘sustained’ marketing investment over several years

Diageo has increased its marketing investment by 60% since 2017 and intends to continue to step up this spend, despite lowered projections for its profit and sales.

Diageo has doubled down on its commitment to sustained marketing investment to drive the growth of its brands, despite a rocky week for the drinks’ giant, which saw it downgrade profit expectations in an unscheduled trading update.

Chief financial officer Lavanya Chandrashekar described the Guinness-owner’s strategy of sustaining and increasing its marketing spend where needed as a “key differentiator” versus its rivals.

“One key insight that we have is that this investment needs to be sustained over several years on a consistent basis to deliver the right outcomes,” she told investors at the company’s Capital Markets Day on Wednesday (16 November).

The drinks company gained “considerable market share” in the markets where it has upgraded its investment, Chandrashekar said. Therefore, it expects to continue to increase its advertising and promotional spending going forward.

These are short term challenges, and we run this business for the long term.

Debra Crew, Diageo

This comes despite headwinds. Last week it posted an sales and profit warning. It had expected that it would see stronger organic sales growth in the first half of its 2024 financial year, versus the second half of its last financial year (which ended 30 June 2023).

It largely attributed this to slower growth in its Latin America and Caribbean region, which last year accounted for 11% of Diageo’s total net sales. Organic net sales in the region are now expected to decline by more than 20% year over year in the first half of fiscal 2024.

The value of shares in Diageo declined 12% in the week following the warning.

Despite reduced expectations, Diageo remains optimistic in what it describes as its ‘growth algorithm’.

“These are short term challenges, and we run this business for the long term,” CEO Debra Crew asserted, re-stating the company’s intention to invest behind its brands as part of this.

Diageo’s marketing spend has significantly increased in the last few years. Since 2017, it has increased this investment by around 60%. In its 2023 financial year, it invested $3.7bn (£2.98bn) in its marketing spend. This means its marketing spend has increased by almost £1.5bn since 2016, when it was £1.56bn.

‘Disciplined’ approach to marketing spend

Diageo’s approach to how it deploys this increased marketing spend will continue to be “disciplined”, Chandrashekar told investors.

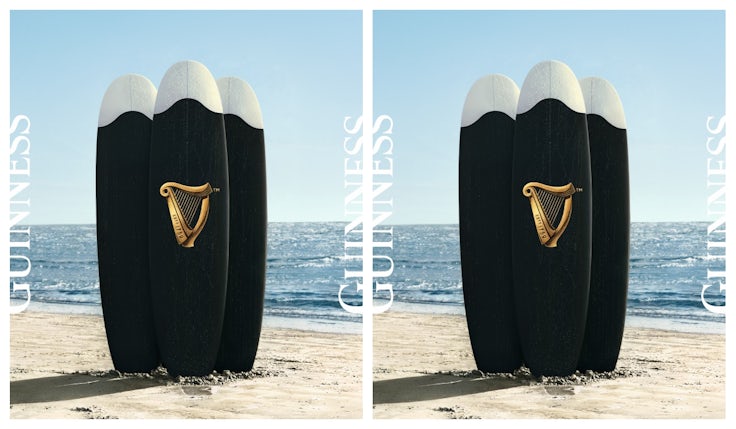

It will focus on upweighting its spend in areas where it is seeing the best return-on-investment. These include the company’s tequila and scotch businesses, Guinness, as well as its no-alcohol portfolios.

Crew, a former marketer who took over as CEO in June, outlined two new proprietary tools being used by the company to help it “focus and prioritise [its] investments toward [its] biggest growth opportunities with the highest opportunity for return”.

The first tool is the ‘consumer choice framework’, which helps the company ‘transcend category thinking’ to reach consumers at relevant occasions with its brands.

The second is the ‘market growth framework’, which establishes roles for Diageo’s various markets and determine where investment goes.

“Ultimately, it helps us remain agile, act fast and effectively channel the full power of our scale where it matters in this volatile world,” Crew said.

In Diageo’s marketing spend specifically, it has seen “significantly” improved ROI with the introduction of proprietary tools to enable effectiveness.

Inside Diageo’s ‘living and breathing’ marketing effectiveness culture

Speaking to Marketing Week earlier this year, the company’s vice president of customer value creation and end to end commercial planning, Kiel Petersen, described its “living and breathing effectiveness culture”.

This includes the use of tools like Catalyst, which helps determine how spend is used across the business, Sensor, which measures performance within channels, and CreativeX, which assesses the effectiveness of ads and looks at how suitable they are for particular channels.

We also go after waste in every aspect of marketing spend, from agency spend to being more choiceful in how we use point-of-sale material, reusing it, and gaining efficiencies on media.

Lavanya Chandrashekar, Diageo

Chandrashekar told investors that the company is also looking to spend more on its total marketing investment on media, and cut out “wastage” where it can, while increasing spend overall.

“We also go after waste in every aspect of marketing spend, from agency spend to being more choiceful in how we use point-of-sale material, reusing it, and gaining efficiencies on media,” she said.

Headroom for growth

Diageo’s brands such as Guinness, Smirnoff, and Johnnie Walker have huge footprints in many markets but the company was keen to assert there is still “huge headroom” for growth in its brands.

As of 2022, the company had a 4.7% value share of the total alcoholic beverage globally. It has ambitions to become the biggest drinks manufacturer, Crew said.

In the wake of Diageo’s trading update issued last week, other drinks businesses, such as Pernod Ricard and Davide Campari saw their shares drop, suggesting concern from investors over the state of the alcohol market.

This Much I Learned: The DNA of Guinness and why that matters in 2023

However, Crew expressed confidence in the alcohol category, and, in particular, in the spirits category. She describes spirits as “a particularly attractive” category, as it lends itself to consumer trends, including premiumisation.

In the last 10 years, premium-and-above spirits have grown from 25% of category value to almost 35%.

She identified four key pillars for the company’s growth: driving growth in Diageo’s biggest brands, expanding its global footprint, utilising its innovation, and raising the bar on execution.

Diageo intends to aggressively pursue these four pillars, with a view to growing its market share across whole alcohol category.

“While we are custodians of incredible traditional brands, we are not standing still,” she stated.