Diageo has upped marketing spend by almost £1bn since 2017

Diageo has hailed the role its rising marketing investment has played in driving business growth, with no plans to slow down any time soon.

Diageo, the company behind brands including Johnnie Walker, Guinness and Smirnoff, has increased marketing spend by almost £1bn over the last six years, as net sales have jumped by £3.4bn.

Diageo, the company behind brands including Johnnie Walker, Guinness and Smirnoff, has increased marketing spend by almost £1bn over the last six years, as net sales have jumped by £3.4bn.

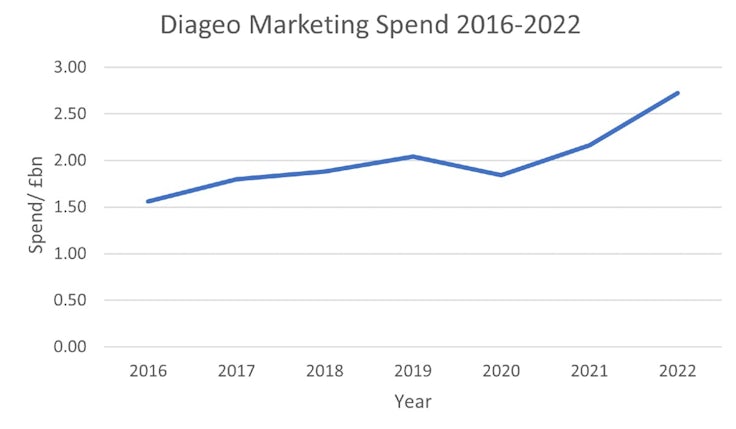

According to the alcoholic drinks maker’s annual reports, in 2017 Diageo spent almost £1.8bn on marketing. In 2022, marketing spend reached over £2.7bn, marking a 51% increase.

Over the same period, net sales have risen from £12.1bn to £15.5bn, or by 28%. Operating profit has increased from £3.6bn to £4.4bn.

Between 2017 and 2019, total marketing spend increased by £244m to a little over £2bn, at an annual rate of between 4 and 8%. However, in 2020 spend dropped by 12% to £1.8bn in response to the coronavirus pandemic. In April that year, Diageo explained it was halting all advertising and promotional spend that would “not be effective” during the crisis.

Yet, by 2021 Diageo had restored marketing spend to £2.2bn, above pre-pandemic levels, even as many on-trade premises remained closed due to ongoing national lockdowns around the world. Between 2020 and 2022, spend rose by 48%.

The drinks giant did make a number of acquisitions over this time period. In 2020, one of its biggest acquisitions was that of non-alcoholic spirits-maker Seedlip, while in 2021 it acquired Aviation Gin, a business co-owned by actor Ryan Reynolds. Diageo also acquired Mescal Union in 2022.

But spend has been increasing ahead of sales growth, and marketing spend as a percentage of net sales grew by 2.7 percentage points between 2017 and 2022, from 14.9% to 17.6%.

In the firm’s 2022 annual report, chairman Javier Ferrán said Diageo believes investing in its brands, even in “periods of volatility”, is the “right way” to grow their long-term equity and the business overall.

“We are responding to our consumers’ evolving tastes and demands with innovation, creativity and precision in our marketing,” Ferrán said.

“Our teams are building brands that are relevant today and which, we believe, consumers will choose for many years to come.”

Last month, Diageo hailed the success of its continued investment in marketing as it reported sales and profit growth for its 2022 fiscal year.

The company is aiming to grow its total beverage alcohol share by 50% by 2030. This would mean an increase from 4% of the total beverage alcohol market in 2020 to 6% by 2030. The company claims that during the past year it gained more share than any of its peers and twice as much as its largest international spirits competitor. More than one-third of this share growth came from Diageo’s super premium plus portfolio.Diageo attributes soaring profits to marketing spend boost and premiumisation strategy

In North America, marketing investment rose 24% over the year to 30 June, ahead of net sales growth, while in Europe Diageo ramped up its marketing spend by 26% to support on-trade recovery and off-trade share momentum.

Across its African business, Diageo increased marketing spend by 22%, focusing on ecommerce and new routes to reach consumers. In the Asia Pacific region, the company’s investment in marketing investment rose by 16%, mainly driven by Greater China and categories such as Chinese white spirits and scotch. Marketing spend also shot up across Latin America and the Caribbean, 49% ahead of net sales growth.

Looking forward, the business says it will continue to use its “deep understanding of consumers” to quickly adapt to changes in trends and behaviours, while “investing strongly” in marketing and innovation even as inflation and the cost of living takes its toll.