Sainsbury’s staves off competition from discounters with ‘record’ Christmas sales

Sainsbury’s focus on value has helped the supermarket fend off competition from the discount supermarkets over Christmas, as traditional grocers battle to maintain market share.

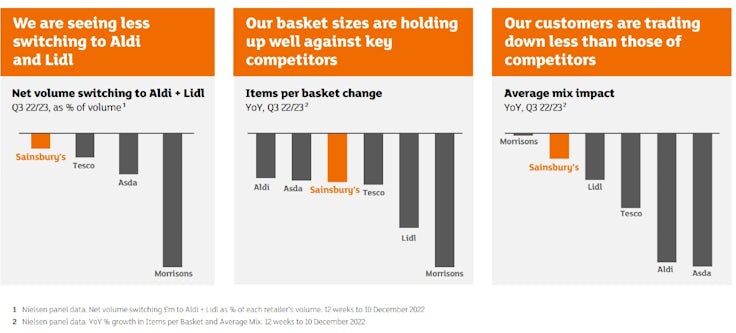

Sainsbury’s saw fewer consumers switch to the discounters over Christmas than its supermarket competitors, the business claims, crediting a “bolder” approach on value, innovation and service for the success.

Sainsbury’s saw fewer consumers switch to the discounters over Christmas than its supermarket competitors, the business claims, crediting a “bolder” approach on value, innovation and service for the success.

In a call with media today (11 January), CEO Simon Roberts pointed to data from Nielsen which suggests the percentage of Sainsbury’s shoppers switching to Aldi and Lidl in the 12 weeks to 10 December 2022 was below that of competitors Tesco, Asda and Morrison’s (see chart below).

Traditional supermarkets have been rapidly losing market share to the discounters in the UK, and in September Morrisons was displaced by Aldi in the “big four” supermarkets. Aldi and Lidl both reported bumper Christmas sales this year.

Lidl saw its sales rise by almost a quarter (24.5%) year on year in the run up to Christmas, while Aldi claimed its “best ever Christmas” with sales exceeding £1.4bn.

Over the last year a core focus for Sainsbury’s has been improving its value credentials, with Roberts reporting the supermarket is “really now making inroads for the first time in terms of customer perceptions of value”. He claimed it now has its “strongest ever price position” against key competitors, singling out Aldi in particular.

We really wanted to help customers strike a balance between saving money and being able to treat themselves.

Simon Roberts, Sainsbury’s

The execution of this strategy contributed towards a 7.1% uplift in Christmas sales compared to the previous festive period for the retail group, which includes both Sainsbury’s and catalogue retailer Argos.

The unusual timing of last year’s winter World Cup also helped to boost sales, the business says. Grocery sales were up 7.1% in the six weeks to 7 January, while general merchandise sales were up 7.4% and clothing sales increased by 5.1%.

The supermarket will maintain its focus on value this year, launching its “biggest value campaign yet” this month and price matching Aldi on approximately 300 products. In 2023, the leadership team is “determined” to continue making “bold” moves and drive forward the momentum it has built up, Roberts said.

Sainsbury’s believes building “trust” across key categories is crucial to keeping consumers shopping with the business.

“When customers trust us on meats and poultry and fish and fruit and vegetables and dairy items, then they don’t have a reason to go anywhere else… and they shop for the wider basket with us,” Roberts said.

“We’ve got that trust building with customers now and that’s why we’re seeing a lot less switching out from our customer base to the limited choice supermarkets than our other competitors who have a similar offer.”

No room for complacency

Sainsbury’s private label products, from its value range to its more premium lines, are delivering both value and quality for consumers, the business claims.

Overall sales of its own brand ranges increased by 10%. Entry price product range Sainsbury’s Basics was the fastest growing sub-brand, the supermarket reports.

While offering value has been a major focus for the grocer in order to maintain market share over the festive period, Sainsbury’s has sought to offer customers a “balance”.

“We really wanted to help customers strike a balance between saving money and being able to treat themselves, particularly if they had more friends and family at home [over the festive period],” Roberts said.

Sainsbury’s heroes premium range in Christmas ad starring Alison Hammond

In line with this goal of allowing customers to treat themselves over the festive season, the supermarket heroed its premium own brand range Taste the Difference in its humorous Christmas ad starring TV presenter Alison Hammond.

Sales of the range grew 10%, up 27% compared to pre-pandemic levels. Roberts told Marketing Week the Christmas campaign “really drove that for us”.

Sainsbury’s strategy “really worked” for it this Christmas, he claimed. However, the supermarket is not resting on its laurels.

“There’s absolutely no complacency… there is a very, very competitive market,” he admits.

However, even in the tough macroeconomic environment, the business is confident in its performance for the rest of its financial year. It expects underlying profit before tax for the year to March to be towards the upper end of the guidance range of £630m to £690m.

Performance in general merchandise

Outside of grocery, it was a “really strong Christmas” for general merchandise, the group reports, with the category showing “stronger than expected growth”.

Roberts credited greater availability as well as the strength of the Click and Collect option at Sainsbury’s and Argos for driving these sales, as Royal Mail strikes meant more people wanted to come in store to pick up purchases.

Argos saw year on year sales growth of 7.1% in the six weeks to 7 January. The retailer’s Christmas campaign acknowledged that the last few years have been “difficult” for consumers, and celebrated the return of the festive family get-together post-pandemic.

“I think it really captured the essence of the Argos brand – people coming together with great value,” Roberts said. “And that really worked for us, as you can see in the Argos performance.”

The retail group is implementing a pay rise for its Sainsbury’s and Argos workers, which will see staff paid at least £11 per hour.

This was described as “an investment in [the] brand”, off the back of a strong Christmas where staff delivered service for the group’s consumers.