Octopus Energy and British Gas brands best placed to benefit from sector consolidation

Brand tracking data shows Octopus Energy and British Gas look in the best health to grow in the energy sector which is currently in turmoil with smaller brands shuttering.

Octopus Energy and British Gas brands look to be in the strongest position to take advantage of the turmoil in the energy sector, according to brand tracking data.

Seven energy suppliers have collapsed since January due to rising wholesale prices. Oil and Gas UK has reported wholesale prices have risen 250% since the beginning of the year with a sharp 70% surge since August alone.

Avro Energy and Green were the latest victims having gone bust last week. The two join People’s Energy, Utility Point, PFP Energy, MoneyPlus Energy, Hub Energy, Green Network Energy and Simplicity Energy in going out of business this year.

UK energy watchdog Ofgem has appointed Octopus Energy to supply Avro Energy’s 580,000 domestic customers, while Shell Energy is to connect the 255,000 customers of Green.

Octopus has received a massive cash injection to the tune of $600m (£437m) from Al Gore’s investment fund to help it develop its global green energy strategy.

Reputation matters

With the energy market rapidly consolidating the brands that remain standing will benefit in the run-up to winter.

The largest energy brands all known as the ‘Big Six’ in the UK are British Gas, EDF Energy, E.ON UK, Npower, Scottish Power and SSE.

Out of the six, consultancy firm Brand Finance highlights British Gas and challenger brand OVO Energy as “best positioned to grow” because of their historically high reputation scores.

Data from Brand Finance shows British Gas scoring the second-highest reputation marks in its ‘Global Brand Equity Monitor’ (GBEM) report released in October 2020 with a score of 6.56, while OVO Energy scored the highest with 6.63. The average score in the sector is 6.22.

Reputation scores are driven by factors such as quality, innovation, being a step ahead of the competition, care about the wider community and commitment to sustainable practices.

Brand Finance managing director Richard Haigh tells Marketing Week, these brands will grow due to “strong performances” across the consultancy’s brand perception metrics.

“Open communication and efforts to drive customer engagement will be critical to protecting their reputation in the long run. Customers in the energy sector expect to interact with energy brands 24/7. Communicating and showing that they are working in their best interests will be key for long-term success,” says Haigh.

According to YouGov’s BrandIndex, Octopus Energy stands in better health than its much larger rivals with a top overall index score at 12.9, overall index takes into account a brand’s score across multiple metrics such as quality, value, reputation and satisfaction to name a few.

This dwarfs second-place EDF Energy at 5.1, Scottish and Southern Energy (SSE) further back at 3.3, British Gas with 3.2, E.ON with 2.5, Scottish Power and Npower bring up the rear at 1.1.

For value for money, Octopus is the clear leader with a score of 10 versus SSE’s -4, EDF Energy and E.ON score -5, while reputation also sees Octopus top by a big margin with a score of 13 and EDF in second with 5. SSE, E.ON and British Gas sit third with each scoring 3.

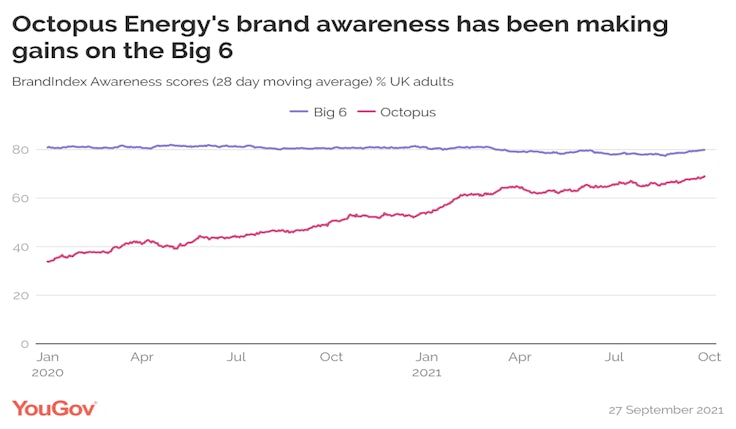

Octopus only began operating in the UK in 2015 and its awareness among consumers is gaining on larger rivals (see chart above). YouGov began tracking the brand in 2019 when it had a score of 38.9 for awareness which has surged to 69 this month. For comparison, the larger brands average at 80.

For customer satisfaction, the bigger brands have an average positive score of 58.8%, but this is surpassed by Octopus Energy’s score of 89.1%.