Ehrenberg-Bass: Linking brand messages to buying situations wins ‘the mind and the market’

Based on the premise that “memories generate sales”, new research from Ehrenberg-Bass urges B2B marketers to build “wider, fresher networks” by tapping into the power of category entry points.

Linking brand messages to key buying situations can increase customer acquisition and retention, proving the “accountability” of B2B brand marketing, according to new research from the Ehrenberg-Bass Institute

Collaborating with LinkedIn’s B2B Institute, the research suggests brand messaging can become fully customer-centric by focusing on category entry points, the cues customers use to access memories when faced with a buying situation. These cues are both internal, such as motives and emotions, and external, including location and time of day.

“Category entry points are not about the brand, they’re about the buyer,” the report’s author Professor Jenni Romaniuk, associate director (international) at the Ehrenberg-Bass Institute, tells Marketing Week.

“That’s what makes them important to understand separately from your brand. You can’t look at your brand and see category entry points, you have to go outside of it.”

The research urges marketers to identify and prioritise the category entry points that matter in their sector, and which their product can serve, linking their brand to category entry points through clear messaging.

“We are aiming for wider, fresher networks and I can’t say that enough. It is contrary to how we’re brought up to believe branding works. It’s contrary to this idea of positioning, finding that one thing you can own to be different from everybody,” Romaniuk explains.

“It’s about saying: ‘There’s lots of different ways people come into a category, we want to be behind as many of those doors as possible.’ That’s the probability game that comes in with this that’s different from everything.”

What’s really important in marketing is not bottom of funnel, lead generation clicks. It’s top of funnel, brand building memory.

Jon Lombardo, LinkedIn B2B Institute

The research reveals the pay-off for B2B marketers adopting this approach could be considerable. Analysis of the US insurance sector found the fewer category entry points a customer links to a brand or company, the greater their likelihood of switching to another brand.

Regression modelling across 17 products suggests, for this sector, each additional category entry point a customer links to a brand in their memory lowers the probability of defection by 5%.

“That single number alone is worth billions of dollars in marketing value,” says Jon Lombardo, global head of research at LinkedIn’s B2B Institute.

The research ties messaging and memory to money, he states, which is “completely different” to the current obsession with clicks. Lombardo suggests Google gets all the credit for a purchase within the industry, with marketers forgetting the “most important search engine” is your brain.

“It’s your memory that got you to Google in the first place and your memory is going to pull strong brands. Strong brands are not built on clicks, but on memories. The other thing that’s very interesting is even when people go to Google and click for something, buyers show a bias for the brands they already know,” he notes.

“This is in some sense the double benefit of brand. It’s more likely to come to mind and even if you do click, you’re still going to click on the strongest brand. It explains what’s really important in marketing is not bottom of funnel, lead generation clicks. It’s top of funnel, brand building memory. That’s the fundamental idea.”

However, Lombardo admits the practice of building memory structures via a thorough understanding of category entry points is far from widespread among B2B marketers.

“One of the primary things people misunderstand is how advertising works. People think they just put an ad in front of you and you immediately buy. That’s not how it works. Generally, you don’t generate any sale from an ad, what you do is generate a memory and then at some point later they consult their memory,” he adds.

“Memories generate sales, clicks don’t generate sales is the very simple way you might put it.”

Head of development at the B2B Institute, Peter Weinberg, suggests the way B2B marketers think about their brand today is either to focus on raising awareness of a specific product solution or link it to “fluffy perceptual attributes” like innovation or friendliness. He describes this new research as offering a “different paradigm”.

“It’s about linking brand to a customer need in a buying situation. I don’t think B2B marketers are really setting those kind of objectives today. It’s either very product oriented, or it’s very perception oriented. It’s not oriented around a buying situation,” Weinberg argues.

The CEP playbook

For Romaniuk, the concept of category entry points blossomed out of the idea that not all memories are equal.

“One of the most depressing things I tell marketers about category entry points is that they would exist even if your brand didn’t. Their customer would be in that context and they would look for something else to satisfy it, which is different from other memories,” she points out.

“In brand health tracking we have a lot of things that are about the brand. Do you trust a brand? It’s not that they’re not useful to know, but they kind of miss the point. These things get generated first. There’s a person coming into this situation and they’ve got thoughts before they’ve even thought of the brand. I call these ‘pre-brand’, because they’re before you’ve even thought about the brand, they’re just what’s going on in people’s lives.”

In a B2B context, she notes a misconception that business decision makers are more circumspect and thoughtful than their B2C peers. In fact, the research notes the B2B buyer is balancing business objectives with their personal preferences and ambitions.

Armed with this knowledge, the approach starts with identifying the category entry points in the sector and prioritising those which relate to your brand, company or portfolio.

To identify the category entry points, Romaniuk suggests considering the different motivators customers consider, from the emotions attached to a purchase and who else is involved in the decision-making process, to timing issues.

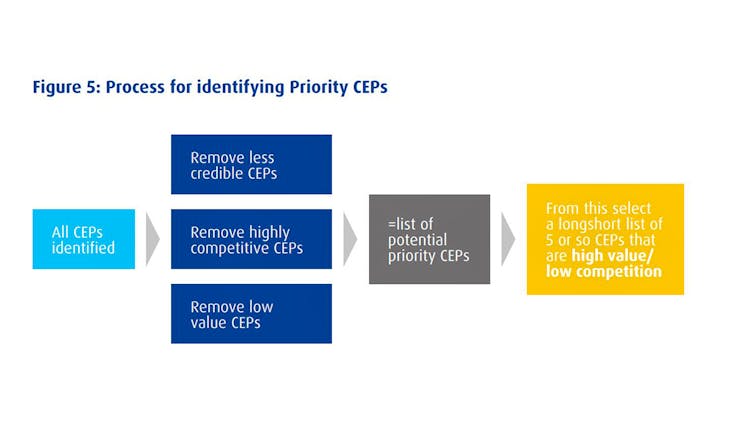

Choosing the category entry points requires a process of elimination, informed by what Romaniuk describes as the three Cs. The first C, credibility, means removing less viable category entry points based on the brand’s historical and current product range.

Next, competitiveness relates to the influence of competitors, their historical marketing activities and product range. The idea is to eliminate cluttered buying situations with lots of competitors advertising the same message.

Lastly, commonality captures the influence of sales from each customer entry point. Some buying situations are less valuable because they are less relevant and/or generate lower revenue.

This leaves the brand with a ‘long shortlist’ of five to eight category entry points that are of high value and represent low competition.

Ehrenberg-Bass: 95% of B2B buyers are not in the market for your products

Romaniuk defines the “strategic” phase of identifying and prioritising category entry points as an important first stage, which does not necessarily need to be updated on a quarterly basis.

“That’s different from the tracking and assessment of it. That depends on how much you’re doing above the line in order to build those memories. If you’re not doing a lot then once a year, once every two years is fine [for the strategic assessment], but you do need to have some systems in place to make sure you’re getting feedback that your marketing activity is working or not,” she advises.

Then it is a case of integrating the brand’s chosen buying situations into its marketing communications, using the category entry point approach as the basis for a creative brief. Businesses should devise a “wide reaching media plan” to quickly build links between the brand and category entry points, says Romaniuk, refreshing the links over time to avoid mental decay and counteract competitors.

What gets measured gets managed

According to the research, as different category entry points are shown in messaging, scaled, repeated and co-presented with the brand, the odds increase that buyers will recall a brand when they are ready to buy.

“The beauty of it is it’s not our classic positioning idea where you go: ‘I want to pick one category entry point and own that’. That’s not how category entry points work. With category entry points we’re aiming for wider, fresher networks. So more, rather than less,” she explains.

“When you’re doing your creative brief, you can give some options and see what sparks people’s thinking.”

In the short term, Romaniuk suggests any one execution needs a single message, but it is important to have multiple creatives, each tapping into a different category entry point. For Weinberg, this approach offers a framework for making hard choices about which messages to prioritise.

“You can’t link yourself to every buying situation in a single execution, so you have a strategic conversation about which buying situation you’re going to prioritise,” he notes.

Lombardo agrees the category entry point method is focused on “extreme message discipline” rather than message diversification, which he regards as a “big flip” for most B2B marketers.

The efficacy of this approach is then backed up by rigorous measurement. The process multiplies mental penetration (a measure of if the brand is present in the memory and has any chance of being retrieved) by the network size (measure of how wide the memory network is amongst those with mental penetration).

The result is a mental market share figure, defined as the brand’s share of customer entry point-brand linkages in the category.

“Measurement matters. There are still people out there measuring mental availability with top-of-mind awareness. They should stop, there is no value in using top of mind awareness,” says Romaniuk.

“Part of the reason I went into such detail in terms of how to measure this is to move people away from the quick and easy, to the more robust and evidence-based approach.”

Unlocking ‘performance branding’

Describing the customer entry point-led approach as “revolutionary”, Weinberg believes Romaniuk has devised a metric that makes sense to finance and sales by quantifying the impact of brand.

“Measurement is probably the biggest gap in brand marketing right now. It’s very difficult to measure and what’s measured gets managed, so this solves that problem,” he states.

Alongside bringing customer entry point messaging into sales scripts, Weinberg highlights the opportunity for marketers to use their insight to advise product teams on the services that tap into valuable buying situations, making marketing a “strategic advisor internally”.

We are aiming for wider, fresher networks. It is contrary to how we’re brought up to believe branding works.

Professor Jenni Romaniuk, Ehrenberg-Bass Institute

CEOs and CFOs care about market share, which is why mental market share will resonate with them, adds Lombardo, who sees the approach of “working backwards from measurement” as a leap forward for brand marketers.

“It is a way for the first time to show the work we do to win the mind actually wins the market,” he states.

“It’s not just that we have mental market share, here are the specific category entry points we have mental market share against and here’s our network size, which we know is important to driving future sales relative to our competitor set. It’s got a very valuable client and competitive context. It brings the client, the competition and the customer all together in one framework.”

According to Weinberg, this research not only forges a path towards the greater accountability for brand marketing, but helps focus briefs to ensure more effective creative is developed. The idea of being able to establish the commercial benefits of brand building, also represents a powerful opportunity for marketers to succeed in business.

“It’s all about the alignment of finance and marketing, performance branding,” says Lombardo.

“This paper is the best thing we’ve ever done to help brand marketers to be more quantitative and the more quantitative brand marketers get, the more likely they are to be able to work with sales and finance, the more likely they are to become a CMO and the more likely they are to be on the board.”