Value of the UK’s top brands drops by 14%

The brand value of UK companies fell 14% this year, compared with 1% growth in 2022, according to BrandZ’s latest UK ranking.

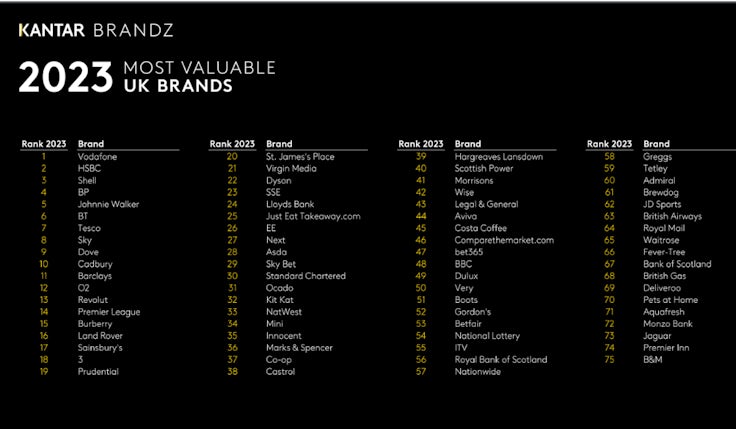

As the cost of living crisis wears on, the brand value of the UK’s leading companies has taken a hit, according to the Kantar BrandZ UK Top 75 ranking.

As the cost of living crisis wears on, the brand value of the UK’s leading companies has taken a hit, according to the Kantar BrandZ UK Top 75 ranking.

The total brand value of UK-headquartered brands fell 14% this year. This is in contrast to 2022, which saw small growth of 1%, but is slightly better than the 20% decline witnessed by the global ranking revealed earlier this year.

The top three brands on the list, Vodafone ($2.6bn), HSBC ($1.89bn) and Shell ($1.8bn) remain in the same positions as in 2022 and 2021. BT, which ranked fourth last year, has dropped to sixth while BP has risen one place from fifth to fourth.

Whisky brand Johnnie Walker is the standout in the top ten, having risen four places to number five this year, with a brand value growth of $10.9bn – a 32% increase on 2021’s figure.

Value of world’s biggest brands drops by 20%It’s not a positive outlook for the UK, but Adele Joliffe, head of brand consultants, insights, at Kantar tells Marketing Week she is not surprised by the results. “It’s the same things which have had a huge effect on share prices and the FTSE 100,” she says, citing the continued impact of the war in Ukraine, cost of living crisis, supply chain issues and inflation on brands and consumers.

“But, as ever, when you go under the bonnet we’re still able to see that it’s the businesses with the strongest brands that do better,” she adds. Such brands include Burberry, the fastest growing brand in the top 20 (+17%, $4.7bn) and Dove, which enters the top 10 this year in ninth place ($6.2bn).

The only new entrants into the annual ranking are Monzo and Premier Inn, in 72nd and 74th respectively. In Monzo’s case, Joliffe suggests the banking brand has managed to avoid the common pitfalls of challenger brands – fast growth followed by hitting the glass ceiling – by elevating its brand and increasing its mental availability with consumers.

Premier Inn has benefited from its position as a purpose-driven brand, says Joliffe, which is to make sure its customers ‘rest easy’. The hotel chain has increased its market share by 4% in the last 10 years, even with the pandemic in the middle. “It has a really consistent personality, and an irreverence in everything it does,” adds Joliffe.

Should UK brands be worried?

A brand value decline of 14%, while in-line with global trends, isn’t particularly encouraging. As Joliffe explains, the UK is “lagging in the medium term” with any success stories this year being the exception to the rule.

In addition to the Top 75 ranking, Kantar analysed eight markets to determine how different from each other consumers perceive them to be. Of the eight, UK brands were rock bottom for how distinctive they are in the eyes of consumers, which is something brands should be worried about.

As she explains, “this dynamic of being more salient, but less different is symptomatic of many brands that have left the UK high street over the last few years, and not dissimilar to the story of what’s happened with Wilko.”

“I’m not saying UK brands are going down the drain,” she adds, “but at the extreme end of this imbalance, where you come to mind quickly but you don’t have the difference to match, you start to see risk enter these brand footprints.”

Methodology

Kantar’s BrandZ valuation process takes the financial value created by a brand in US dollars and multiplies it by brand contribution. The result is Brand Value – the dollar amount a brand contributes to the overall value of a corporation. Isolating and measuring this intangible asset reveals an additional source of shareholder value that otherwise would not exist.

That brand contribution is derived from consumer research that quantifies how much of the volume people purchase and how much of the price premium people pay can be attributed to brand equity, connecting what people think to what they do.

Kantar’s annual global and local brand valuation rankings combine rigorously analysed financial data, with extensive brand equity research. Since 1998, BrandZ has shared brand-building insights with business leaders based on interviews with 4.2 million consumers, for 21,000 brands in 54 markets.