‘We have work to do’: Unilever outlines plan to tackle ‘unacceptable’ competitiveness

Unilever’s performance “needs to improve”, CEO Hein Schumacher told investors, outlining an action plan involving innovation, a refreshed approach to superiority, and brand investment.

Unilever’s recent record on competitiveness in winning market share has been “unacceptable”, according to its leadership.

Unilever’s recent record on competitiveness in winning market share has been “unacceptable”, according to its leadership.

Just 37% of Unilever’s business won market share last year, the business told investors during its full-year 2023 earnings call today (8 February).

“Our current level of competitiveness is unacceptable,” chief financial officer Fernando Fernandez said.

The company attributed this performance to consumer shifts to private label in Europe, moves towards super-premium in North America, and its own decision to cut “unprofitable” product lines from its portfolio.

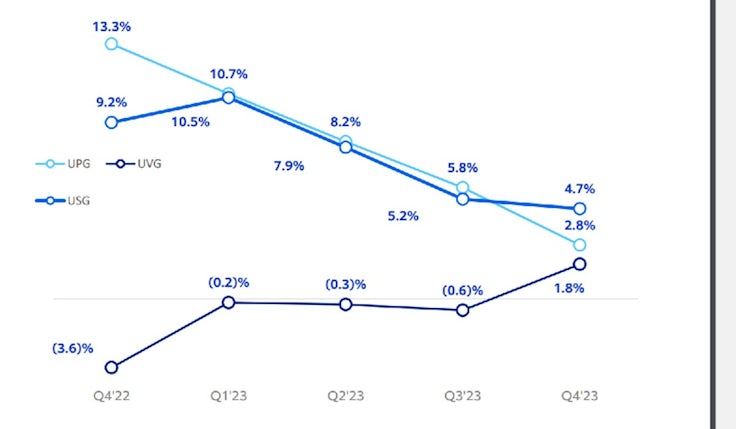

The company did see a return to slight volume growth of 0.2% for the year, driven by the final quarter of the year when the company grew volumes by 1.8% versus the same period in 2022. Europe was “the main drag” to volume growth. Across the year, volumes declined 7.7% in the region.

The company’s underlying sales grew by 7%, with price still “contributing strongly”, despite the rate of inflation beginning to moderate. Price increases contributed 6.8% of that growth in the year. The business is forecasting “more balance between volume and price” in 2024, with underlying sales growth expected to be between 3% to 5%.

While CEO Hein Schumacher, who took over leadership of Unilever in July 2023, said today’s results indicated “an improving financial performance”, he deemed the company’s competitiveness “disappointing”.

“Overall performance needs to improve,” he said.

“We are not sitting on our laurels… we’ve presented a clear action plan,” Schumacher added.

That “growth action plan”, first presented in October, was elaborated on by the CEO today. It hinges on three goals: faster growth, productivity and simplicity, and performance culture.

Unilever CEO: We will stop ‘force fitting’ purpose to our brands

This is underpinned by “one simple premise: the need to do fewer things better and drive greater impact, leading to a single overarching objective, the consistent delivery of high quality, top-line growth ahead of our markets,” Schumacher said.

“I would love to say that we are within touching distance of that objective, but we are not. We know that we have work to do,” he said.

He outlined 10 steps for how Unilever intends to work towards that objective in practice. The first step was Unilever’s renewed focus on its 30 “power brands”. These brands represent around three-quarters of the business’s turnover.

Schumacher said “the vast majority” of the company’s brand and marketing investment is going behind these brands and indicated that will continue into 2024.

Unilever will also invest more into that brand and marketing budget, Schumacher pledged. In 2024, it reinvested over half of its gross margin expansion into incremental brand and marketing investment, it reported.

Driving growth for the business is primarily about “better execution” and leveraging Unilever’s scale better, Schumacher said. One way it is doing this is by changing how it approaches product superiority.

“We are using a highly rigorous and quantifiable process to completely change the way we think about and measure brand superiority,” said Schumacher.

Make this the year you innovate

The process will be rolled out across key geographies for Unilever’s 30 “power brands” in the first half of this financial year, with the aim of identifying any gaps and improving performance.

“Our power brands will also benefit from an equally new and distinctive approach that we are taking to the way that we think about and systematise innovation,” Schumacher said.

The focus here will be on “big platforms, not small projects”, and prioritising projects that develop markets or drive premiumisation.

“We are confident that, taken together, the increased rigour and prioritisation we apply both to brand superiority and innovation will help to drive the performance of our power brands, and with it the overall growth prospects for the business,” Schumacher stated.